|

|

|

Main

Page by Topic |

||

|

C. Statistics |

||

Vendor

Risk Management (VRM)

See Also: Vendor Risk Audit

Checklist

See Also: Vendor

Risk Mitigation

Overview

Provides an

introduction to Vendor Risk Management in the context of CTRM Software,

including observations and considerations on how the rise of Big CTRM impacted the

Vendor Risk profile of impacted firms.

Figure Thumbnails

|

Figure

1 |

Figure

2 |

Figure

3 |

1) Different Kinds of Risk Firms Face

2) What Is Vendor Risk And Why Has It Become

Important Again?

3) Vendor Risk: Perceived versus Actual

4) Vendor Risk Mitigation – What Can Be Done To Reduce Vendor Risk?

1) Different Kinds of Risk Firms Face

Firms that

trade in commodities, hedgers, market makers, speculators are very well aware

of the following three main types of Risk:

Market Risk – the risk that market prices move

against, i.e., that you lose money due to price changes

Credit Risk – the risk that your counterparty does

not pay you back in full for money they owe you

Operational Risk – the risk that one of a myriad of

operational items is not done as it should.

For example, an invoice does not get send out that should, or a payment

due is overpaid, or an option that should have been exercised was not.

For those

risks, they are given a lot of visibility within a firm, with daily reporting,

and often a person or team in a role, e.g., ‘Credit Risk Department’.

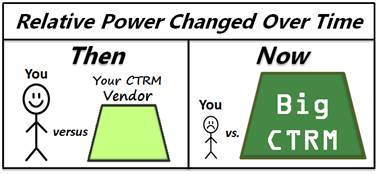

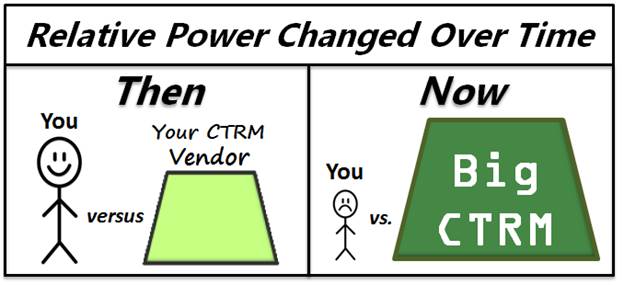

Vendor risk is

another category of risk that should also be of concern for commodities firms

that use a vendor, especially a Big CTRM vendor, for their CTRM solution. See Figure #1.

2) What Is Vendor Risk And Why Has It

Become Important Again?

2.1) Vendor Risk encompasses all of these

items:

1) The risk

that your CTRM Vendor goes out of business. Leaving you with a ‘stranded’ system, i.e.,

one that won’t be getting future upgrades.

2) The risk

that your CTRM vendor stops supporting your particular Software Package. For example, if a Big CTRM vendor buys up

several software companies, each with similar offerings, and then decides that

it will maintain just one of them. If

your firm is on the wrong one, you might have the unexpected costs of needing

to switch systems, even if it they are both from the same vendor.

3) There is

also the risk that your CTRM vendor materially reduced their annual investment

into the software. For example, what if

they used to have 100+ developers and then reduce down to just 10.

4) As a

variation… it is not just the number of developers that counts… it is also how

much of a working knowledge they have.

There could be a ‘brain drain’.

For example, if 40 people with a vast working knowledge of the software

leave and are replaced with new people.

E.g., the original creators are gone and the new people can’t develop

nearly as quickly. The effective number

of people has been reduced, to your detriment.

5) The risk

that the level of service drops in other areas, such as the support desk. i..e, the technical help desk.

Perhaps you have

5.1) Longer

waits

5.2) Lower

qualified people. E.g., maybe you used

to be able to get an actual product manager or developer on the phone. And maybe that changes to where you are just

getting a generic call center.

5.3) Nickle and diming. Perhaps you used to get a

certain number of system-training questions answered for free, as a courtesy

given that your firm pays a lot in maintenance.

The vendor may require that ever minute be billable work to their

services group.

6) Increased

costs for add on and additional licenses.

E.g., adding new ‘engines’ maybe used to cost $10k and now cost

$25k.

7) Switching

from the customer-friendly perpetual licensing approach to the restrictive approach

of forcing users to pay each year to use the software. With a perpetual license, if a firm decides

to stop paying the vendor maintenance, they are still legally able to use the

software forever, i.e., in perpetuity.

Not so with the more restrictive license.

8) Less

frequent user conferences and/or, in the case of Big CTRM, combining many

software packages into one User Conference instead of having a higher value-add

dedicated user conference for each.

2.2) And why it

is important again…

This section

specifically describes the relationship of firms to Big CTRM.

As recently as

a few years ago, firms that used a Big all-in-one CTRM

system had a somewhat equal relationship with their vendor. There was stability over time.

More recently,

industry consolidation and the rise of Big CTRM has

undermined that stability.

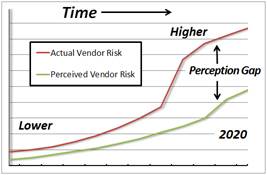

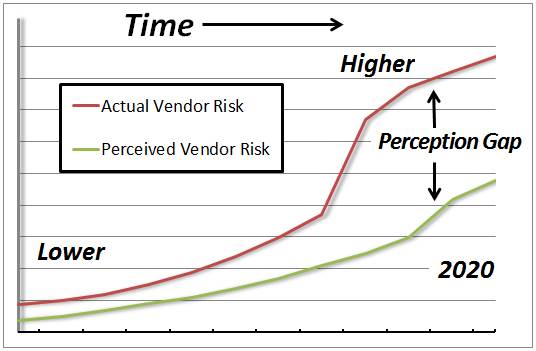

3) Vendor Risk: Perceived versus Actual

The important thing

to remember is that in an industry as diverse and widespread as the CTRM

industry, the perceived Vendor Risk, i.e., the perception of trouble,

can lag well behind the actual risk.

For example,

many commodity trading firms are several versions back with regard to the

version of the software that they use.

E.g., the most recent big upgrade may be 3 to 5 years prior. How would they know if a Big CTRM firm

dramatically scaled back on their enhancements to the software.

Or perhaps a

firm only asks for additional licenses every 18 months or so as they slowly

grow. They won’t necessarily be aware of

a dramatic price change or a detrimental switch away from Perpetual Licensing

until the next time they ask for some additional licensing, which may be not for

a year.

4) Vendor Risk Mitigation – What Can Be Done To Reduce Vendor Risk?

The good news

is… there is plenty that a firm can to do mitigate, to reduce their Vendor Risk. Click on the link for the details:

Link: Vendor Risk Mitigation Opportunities

5) Vendor Risk

Audit and Audit-assist Checklist

Click on the link

below for recommended practices for a firm using a Big CTRM system around the

concept of a ‘Vendor Risk Audit’ and provides a useful checklist to help with

the process.

Link: Vendor Risk Audit and

Checklist

Introduction to

CTRM

Click on this

link for a great introduction to CTRM software: Introduction to CTRM Software