|

|

|

Main

Page by Topic |

||

|

C. Statistics |

||

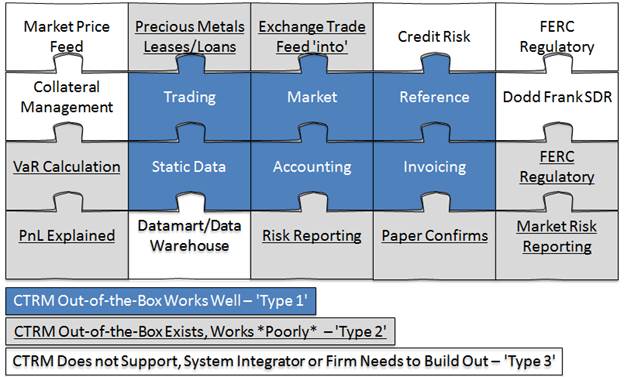

Jigsaw Puzzle Model for a CTRM Solution

Overview

This page

introduces a model of a CTRM based on a jigsaw puzzle metaphor.

This model, in

this case meaning a visual representation for the way things

work, has some benefits in terms of facilitating communication. We’ll use the language of this metaphor to

make some important points below.

One key point

to make right now, which we’ll repeat and elaborate on below:

To

succeed, a CTRM solution just needs to cover the ‘core’ areas that a firm needs

as part of their overall technology solution. It

doesn’t need to do ‘everything’. Why is

that? Because that is the current model

for existing vendor-supplied CTRM solutions, at least at the larger firms using

CTRM.

Outline

1) Jigsaw Puzzle Model/Paradigm – Introduction and Commentary

2) Diagram 1 – Typical CTRM System Coverage for One Firm – Legacy

World

3) Diagram 2 – Typical CTRM System Coverage for One Firm – Legacy

World, high level/summarized

4) Diagram 3 – CTRM System Coverage for One Firm – Future State –

With NewCTRM Replacing Core

5) Diagram 4 – CTRM System Coverage for One Firm – Legacy and

Future State Side by Side

1) Jigsaw Puzzle

Model/Paradigm - Introduction and Commentary

Have a look at

each diagram and then read the text that follows for commentary.

Typical CTRM

System Coverage for One Firm – Legacy World

Commentary

1.1) The idea here is that the entirety of the diagram, the full

length and width, is what a firm needs for a software/technology solution to go

live, i.e., to have a working commodities trading solution at their firm. We’ll call this the ‘overall solution

landscape’.

1.2) With the overall solution landscape, we have different bits of

functionality. You could call these

‘components’ in a non-technical sense of the word. We have modeled these as pieces in a jigsaw

puzzle.

1.3) It should be understood that the modeling is somewhat

conceptual. The above diagram

suggest that each piece of the puzzle in the overall system landscape is

something you can swap in and out for another similar piece. i.e., ‘plug and play’.

1.4) While it can be tempting to read the labels of each of the

pieces and start to form conclusions, we’ll note that the labels, e.g., ‘PnL

Explained’ are just examples. The

specific features will vary from one firm to another. So we called this a ‘Typical’ example of

system coverage for one firm.

1.5) A key point that this diagram makes is with the center

pieces. Labeled ‘Type

1’ above. These are the things,

or meant to represent the things, that CTRM systems do well. These are also the most common functionality

and also that means the most commoditized, ‘least value add’

functionality. For example, this could

be modeling a financial commodity swap.

Pretty much every system is going to model these in a similar way, since

all of the firms are trading the same thing with one another.

1.6) The ‘Type

2’ items are features that are nominally supported by the vendor CTRM system,

but that it does not do them well. The

‘PnL Explained’ piece above is shown as an example of this. This is intended to be a typical example

that covers an average firm (system user) and average vendor. For another firm, they might find that the

PnL Explained offering from the CTRM system works great for them.

As an example,

Microsoft Windows comes with a program called ‘Paint’ (or ‘MSPaint’). It works fine for light graphical editing and

it’s free (included). However, it is no

match for a paid professional graphics software package.

With the

current typical landscape, firms can’t easy swap out, for example, the CTRM

vendor’s ‘ok’ PnL Explained for an alternate.

Though for most big CTRM systems, firms can invest in extensive

customization of the out-of-the-box version or even build their own tightly integrated

version. The problem here is, that if

you have 10 firms, they all might build out their own PnL Explained (or data

warehouse, etc.) solution so it gets somewhat inefficient.

With the new

model/paradigm for NewCTRM, we not only want to make it easy to ‘plug and

play’… we want to support an encourage an ecosystem

around the core NewCTRM solution where firms can build out new ‘pieces’ and

sell/license them. If we build out the

core parts, i.e., the common parts, the ‘least value add’ parts… we think the

market (i.e., entrepreneurial firms) will offer competitive solutions to fill

out the rest of the pieces. That is

something that is actively discouraged now by legacy CTRM vendors.

1.7) The ‘Type

3’ puzzle pieces in the diagram above represent features that a legacy CTRM

vendor doesn’t support, doesn’t have.

Remember though, we agreed a firm would need the entirety of the puzzle

to go live on commodities trading. So

if a CTRM vendor doesn’t have it, then in the current world, firms would need

to build it out from scratch. E.g., a

data warehouse (or ‘datamart’) is a good example of

that. We can assume that it is either

firms themselves or a system integrator (consultants) that build out the

missing pieces.

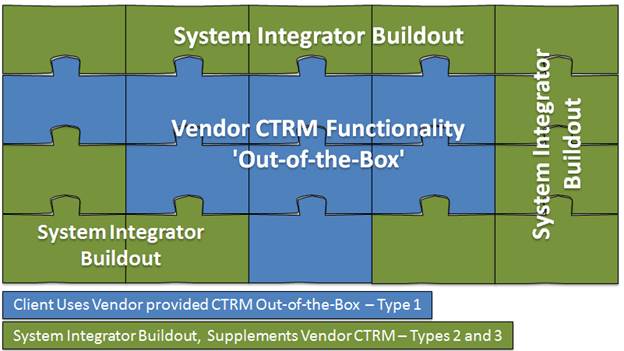

Typical CTRM

System Coverage for One Firm – Legacy World – High Level/Summarized

Commentary

2.1) This is meant to show the same concept as from ‘Diagram

1’. The difference here is that the

pieces are grouped together based on whether they are being met by:

2.1.1) The legacy CTRM vendor. These are the pieces in the middle,

noted as ‘Type 1’. This is the core

functionality that pretty much works the same for all vendors and clients.

2.1.2) Being built out by either a firm using the CTRM or the

System Integrator working for that client.

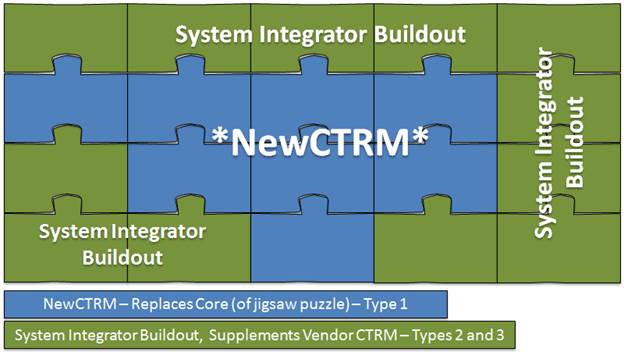

CTRM System

Coverage for One Firm – Future State – With NewCTRM Replacing Core

Commentary

3.1) This is meant to show the future state with the new ‘NewCTRM’

replacing the core pieces. This is a

good idea, since we already established that this part if the most common, meaning most commoditized functionality

and the least value add. This

can’t be a source of competitive advantage, since firms are already sharing the

same solution for this in the current world, i.e., from a common CTRM Vendor.

3.2) This shows that a CTRM solution doesn’t need to do

‘everything’. It can succeed and excel

just by doing the core/common features and it can be an improvement by being

more open and standardized.

3.3) You might call the above diagram ‘Phase 1’ for NewCTRM. This diagram is assuming that it basically

still the same amount of work to implement a NewCTRM as a traditional

vendor-supplied CTRM, meaning just as much custom buildout. However, it won’t need to be that hard. The market will be open for enterprising

firms to build instantly compatible ‘pieces’ of the puzzle. E.g., a best of breed interface from ICE (for

futures trades into the CTRM system) or a super-functional PnL Explained

reporting solution. With the ‘Phase 2’

model, the core CTRM could be thought of like ‘the App Store’ or a platform

like Windows, where there can be an ecosystem of competing products and

services that supplement the core NewCTRM.

This ‘Phase 2’ approach and benefits will be discussed in a future blog

post.

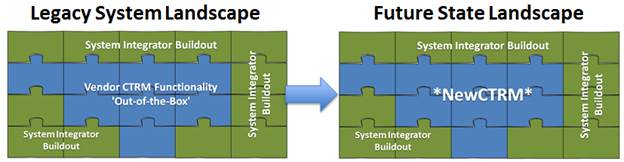

CTRM System

Coverage for One Firm – Legacy and Future State Side by Side

Commentary

4.1) This is just one more diagram, intended to summarize things

for you.

Introduction to

CTRM

Click on this

link for a great introduction to CTRM software: Introduction to CTRM Software